The housing market and the economy at large have taken a wild ride this year, with home prices clinging to historic highs and mortgages hitting rates far surpassing the lows of 2021.

Combined with inflation, the rollercoaster ride has given homebuyers pause, even as it signals a gradual recovery of housing inventory.

Realtor.com now anticipates home sales to decrease by 6.7 percent over the course of 2022, compared to previous forecasts of sales increasing by 6.6. percent.

Where’s the best place to wait out all the ups and downs in the market? According to an analysis by CNBC that weighed each state’s economic health, annual home price appreciation, new construction per year and foreclosures and insolvency from the first quarter of 2022, Utah has the most stable housing market in the country right now.

The financial news outlet drew data from the recently released CNBC America’s Top States for Business study, the Federal Housing Finance Agency (FHFA), the U.S. Census Bureau and Attom Data Solutions.

See all the details of the most stable housing markets below.

1. Utah

Old Paria, Utah | John Fowler / Unsplash

2022 Economy ranking: 6

Home price appreciation: 27.1 percent

Housing starts per 1,000 people: 12.2

Foreclosure rate: 1 in 2,063 housing units

Underwater mortgages: 1.4 percent

Utah, undoubtedly, has a hot housing market right now.

The state boasts the second-highest rate of rising home prices in the country, but also the fastest rate of new construction. In addition, its foreclosure rate is low and the economy is in a strong position.

2. Washington

Seattle | Photo by Luca Micheli on Unsplash

2022 Economy ranking: 3

Home price appreciation: 20.1 percent

Housing starts per 1,000 people: 7.3

Foreclosure rate: 1 in 4,965 housing units

Underwater mortgages: 1.2 percent

Although Seattle has often been pinned over the years as a city with a severe housing crunch and affordability issues, the state’s sustained economic growth has helped place it in a strong position on this ranking list. Additionally, foreclosure rates and underwater mortgages are quite low.

3. Florida

St. Augustine | Lance Asper / Unsplash

2022 Economy ranking: 4

Home price appreciation: 25.7 percent

Housing starts per 1,000 people: 9.6

Foreclosure rate: 1 in 1,211 housing units

Underwater mortgages: 1.4 percent

There have been conflicting reports over the course of the pandemic about whether or not everyone is moving to Florida, with its attractive weather year-round and favorable taxes.

Still, rising prices and rates of construction reflect strong demand, at least for now.

4. Texas

Austin, Texas | Carlos Alfonso / Unsplash

2022 Economy ranking: 8

Home price appreciation: 19.3 percent

Housing starts per 1,000 people: 8.9

Foreclosure rate: 1 in 2,326 housing units

Underwater mortgages: 2.5 percent

Texas is another state that’s seen a lot of press in the last few years for its growing population, as buyers in pricier markets like California got fed up with the competition during the peak of the pandemic-fueled housing market.

In response, home construction is up to help meet demand and there are plenty of qualified buyers ready to adopt those new homes.

5. Idaho

Boise, Idaho | Click Sluice / Unsplash

2022 Economy ranking: 5

Home price appreciation: 27 percent

Housing starts per 1,000 people: 10.5

Foreclosure rate: 1 in 6,015 housing units

Underwater mortgages: 1.6 percent

Boise has consistently ranked as one of the nation’s hottest markets, contributing to overall strong housing demand throughout the state.

New construction is helping bolster the state’s inventory, CNBC’s report noted, but foreclosure rates are also on the rise (albeit still, quite low compared to other states), which may be a warning signal if the economy takes a sharp downturn.

6. Tennessee

Nashville, Tennessee | Brandon Jean / Unsplash

2022 Economy ranking: 2

Home price appreciation: 24.1 percent

Housing starts per 1,000 people: 8.2

Foreclosure rate: 1 in 2,797 housing units

Underwater mortgages: 2.9 percent

According to CNBC’s analysis, Tennessee has the second strongest economy in the country behind North Carolina.

The stable housing market and rising prices have largely contributed to this factor. However, the report also warns that foreclosures and underwater mortgages have been on the rise.

7. Vermont

Champlain Valley, Vermont | Kevin Davison / Unsplash

2022 Economy ranking: 33

Home price appreciation: 2o percent

Housing starts per 1,000 people: 3.2

Foreclosure rate: 1 in 13,930 housing units

Underwater mortgages: 1.1 percent

Individuals seeking an escape from larger cities have given Vermont’s housing market a boost, contributing to rising prices and new mortgages. Despite these healthy signs, the state’s economy and new construction have both lagged, bringing down Vermont’s overall ranking.

8. Arizona

Piestewa Peak, Arizona | Kyle Kempt / Unsplash

2022 Economy ranking: 22

Home price appreciation: 27.4 percent

Housing starts per 1,000 people: 9

Foreclosure rate: 1 in 1,861 housing units

Underwater mortgages: 1.4 percent

Arizona has become another Sun Belt hot spot, with spiking home prices and low inventory.

However, the state’s construction surge should provide some needed relief. Increasing foreclosure rates are something to keep an eye on, CNBC’s report noted, but home equity generally is in a strong position.

9. South Carolina

Charleston, South Carolina | Leonel Heisenberg / Unsplash

2022 Economy ranking: 13

Home price appreciation: 21.4 percent

Housing starts per 1,000 people: 9.5

Foreclosure rate: 1 in 1,081 housing units

Underwater mortgages: 3.4 percent

South Carolina is in the midst of a very heated market, with tight inventory and regular bidding wars, helping prices to continue to rise.

However, strong new construction starts should eventually help mitigate that demand in upcoming months.

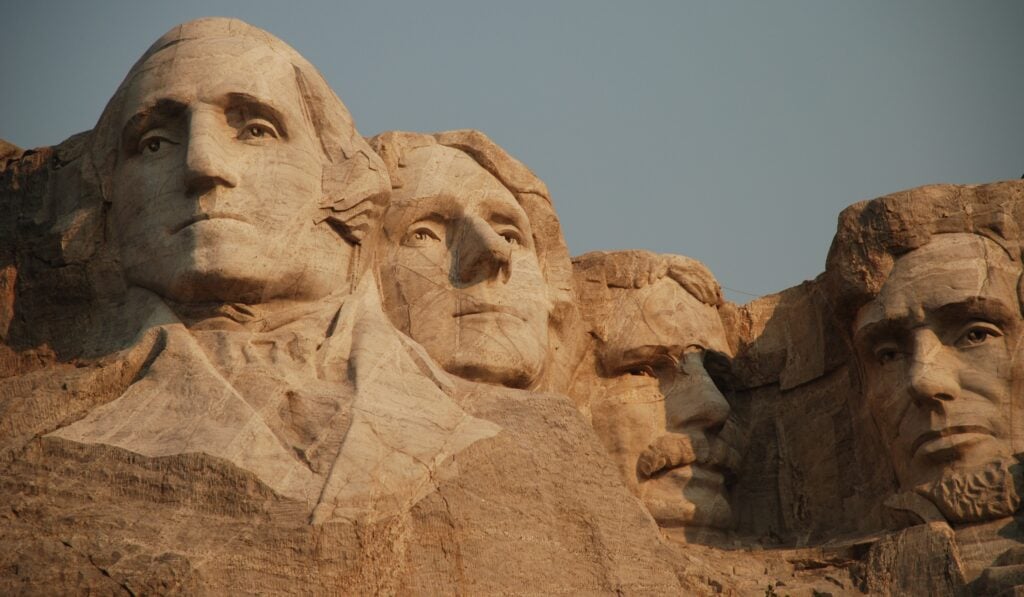

10. South Dakota

Mount Rushmore, South Dakota | Ronda Darby / Unsplash

2022 Economy ranking: 12

Home price appreciation: 20.1 percent

Housing starts per 1,000 people: 8.8

Foreclosure rate: 1 in 17,724 housing units

Underwater mortgages: 4.8 percent

South Dakota’s economy is in good standing with home price appreciation still going strong and housing starts also at a healthy pace.

The foreclosure rate is extremely low. However, with underwater mortgages increasing, some trouble may be brewing for the housing market, CNBC noted.