J.D. Power’s annual Mortgage Servicer Satisfaction Study finds customer satisfaction is 26 percent higher when mortgages are originated and serviced by the same company.

In a shifting real estate market, the guidance and expertise that Inman imparts are never more valuable. Whether at our events, or with our daily news coverage and how-to journalism, we’re here to help you build your business, adopt the right tools — and make money. Join us in person in Las Vegas at Connect, and utilize your Select subscription for all the information you need to make the right decisions. When the waters get choppy, trust Inman to help you navigate.

Mortgage lenders are increasingly bringing their loan servicing businesses in-house because it provides a source of revenue that’s not as subject to the ups and downs of the real estate cycle and gives them a better shot at refinancing existing customers when mortgage rates drop.

But it turns out there’s another benefit — lenders are likely to lose the trust of their customers if somebody else is responsible for collecting the monthly payments on the loans they originate.

That’s one takeaway from J.D. Power’s annual Mortgage Servicer Satisfaction Study, which found overall customer satisfaction is 26 percent higher when mortgages are originated and serviced by the same company rather than outsourced to another company for servicing.

Only 15 percent of borrowers whose loans are transferred to another company for servicing say they’d be “very likely” to consider using the original lender in the future, the study found.

Loan servicers not only collect monthly payments from homeowners but help them navigate alternatives to foreclosure when they have trouble making their payments. With a recession seeming increasingly likely and mortgage loan delinquencies on the rise, customers “want to be assured their mortgage servicers are on their side,” J.D. Power said in summarizing the study.

“In a time when brand reputation, customer trust and customer satisfaction are going to be even more critical for attracting and retaining business, different business models will be put to the test in different ways,” J.D. Power executive Craig Martin said in a statement. “Managing to the average is dangerous. Firms that are selling the value of the end-to-end relationship and working to build customer advocates will not succeed if they are satisfied with only being technically proficient.”

J.D. Power surveyed 8,098 borrowers who have been making their monthly mortgage payments to the same servicer for at least one year and found that overall customer satisfaction scores averaged 646 on a 1,000-point scale when loans were originated and served by the same company.

Overall customer satisfaction dropped 133 points to 513 in cases where the loan had been transferred to a servicer that is different from the originator.

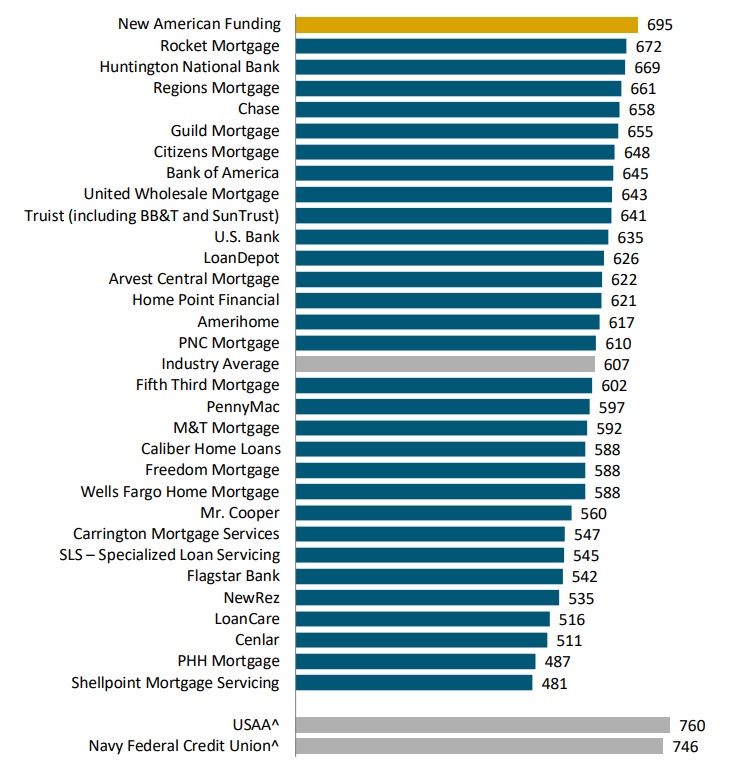

New American Funding, a technology-driven direct lender which recruited mortgage industry veteran Roger Stotts in 2014 to launch in-house servicing, ranked highest among mortgage servicers with an overall customer satisfaction score of 695.

Rocket Mortgage, which has grown its mortgage servicing portfolio by 17 percent from a year ago and is now collecting payments on more than $546 billion in mortgages from 2.6 million borrowers, ranked second with an overall customer satisfaction score of 672.

Also scoring above the industry average of 607 were Huntington National Bank (669), Regions Mortgage (661), Chase (658), Guild Mortgage (655), Citizens Mortgage (648), Bank of America (645), United Wholesale Mortgage (643), Truist (641), U.S. Bank (635), LoanDepot (626), Arvest Central Mortgage (622), Home Point Financial (621), Amerihome (617) and PNC Mortgage (610).

J.D. Power 2022 U.S. Mortgage Servicer Satisfaction Study

Pictured are overall customer satisfaction index rankings on a 1,000-point scale, based on surveys of 8,098 borrowers who have been making their monthly mortgage payments to the same servicer for at least one year. Source: J.D. Power.

USAA and Navy Federal Credit Union scored high but were not ranked because they did not meet the study’s award criteria.

Servicers scoring well below the industry average of 607 include ShellPoint Mortgage Servicing (481), PHH Mortgage (487), Cenlar (511) LoanCare (516) and NewRes (535).

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.