Join us at Inman Connect New York this January for 75+ educational sessions, 250+ expert speakers, and networking opportunities with thousands of industry professionals. Register today for our Labor Day special rate good through September 5! Check out these just announced speakers for this must-attend event. Register here.

When it comes to real estate stocks, it hasn’t been their day, their month, their week or even their year.

More specifically, recent days have seen the market hammer an array of real estate companies’ share prices. In multiple cases, companies have hit all-time lows. And those new lows in many cases come after more than a year of steady declines.

The result is that publicly traded real estate companies are collectively worth billions less than they were in just the recent past, shares have dipped into penny stock territory and in some cases the risks of insolvency and delisting from the stock market loom.

The cause of these troubles is more complex than simply a housing downturn. But either way, if real estate firms can’t ultimately turn around their stock market performances, their falling share prices could have profound impacts on the real estate industry.

A very bad week after a very bad year

The last few days have been absolutely brutal to real estate stocks.

Compass shares, for instance, hit an all-time low price of $2.62 on Thursday. By Friday they had rebounded slightly to above $2.70, but that’s a very far cry from the more than $20 per share, which is where they landed after the brokerage’s first day of trading back in April 2021. Compass shares have bounced around over the last year-and-a-half, but overall the price has been on a consistent downward trajectory.

Credit: Google

Compass gets a lot of attention because it’s big and because company leaders recently announced a cost-cutting plan designed to achieve profitability for the first time. But the company is far from the only firm currently experiencing a rough ride on the stock market.

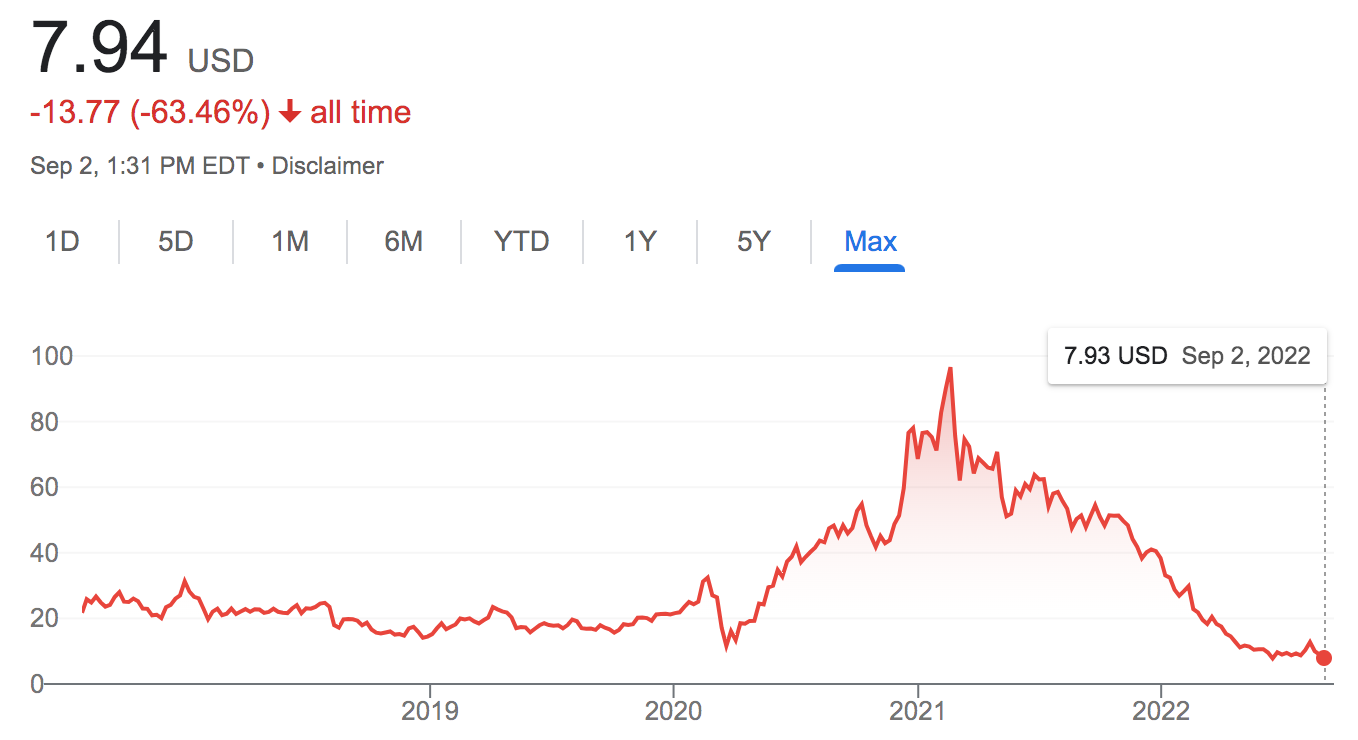

Redfin also hit an all-time low this week, with shares dropping to barely more than $7 Thursday before rebounding to nearly $8 on Friday. Redfin went public in 2017 so it has a longer track record compared to Compass. For the first several years the company offered shares, prices hovered in the teens and twenties. But beginning in the spring of 2020, shares soared until they eventually reached nearly $100 in February of 2021.

Since then, however, Redfin’s share price has been steadily falling.

Credit: Google

A similar story is playing out again and again among real estate companies. Zillow stock was trading for about $34 per share Friday afternoon — not an all-time low but still, a dramatic fall from the more than $200 shares were fetching in early 2021.

Opendoor stock fell to barely more than $4 per share this week, down from both the $10 shares were getting after the company’s public debut and from the mid $30 range Opendoor hit in February 2021.

Offerpad, which has the distinction of being the most consistently profitable dedicated iBuyer, saw shares fall to $1.40 Friday, an all-time low and precipitous drop from the more than $10 per share the company was pulling in after going public.

Offerpad also offers a case study on what happens to market caps — or the valuation of a company — when share prices fall off a cliff. Offerpad had a market cap of about $2.7 billion when it went public. Today, the company is worth a comparatively paltry $347 million. All the companies with plummeting share prices have seen similar drops in their market caps.

Some other companies in real estate have had a somewhat rough recent past in the stock market, though their shares aren’t bottoming out. Anywhere falls into this category. The company’s shares were trading Friday in the mid $9 range. That’s down from all-time highs way back in 2013 and from last fall when shares were trading in the mid-teens. But it’s up from all-time lows in the spring of 2021.

EXp World Holdings, parent of eXp Realty, has also not hit all-time lows this week. But with shares trading in the mid $12 range Friday, the company has still lost a lot of ground compared to February of 2021 when share prices neared $80.

Why are shares falling?

Some of the explanations for this sweeping trend are obvious. The stock market itself has sputtered over the last year, and more recently the housing market has cooled considerably. Both are factors in real estate companies’ stock market struggles.

But most real estate companies also began struggling well before the current market downturn, when the housing market was at its hottest point in years.

John Campbell

John Campbell — a managing director at financial services firm Stephens Inc. who focuses on the real estate sector — told Inman, that real estate companies have consistently underperformed relative to the rest of the market.

“The real estate space is uniquely bad right now,” he said.

Campbell said this phenomenon is partially perplexing. Typically when a stock is oversold, he explained, investors will see a bargain and begin buying it again, which drives the price back up somewhat. But that hasn’t been happening with real estate stocks.

“This has been perpetual pain to the point that it’s puzzling,” he added.

But it does seem like investors’ appetites are leaning into some business models rather than others. Campbell pointed out that RE/MAX — which was trading in the mid $22 range Friday and which has been fairly consistent since this spring — has underperformed less than other publicly traded real estate companies. Campbell noted too that RE/MAX is a franchisor, more akin to a Dunkin Donuts or Papa John’s Pizza than a brokerage like Compass. And that apparently buoyed RE/MAX shares in the minds of investors.

On the other hand, companies that have been hit especially hard include those focused on tech, those that aren’t profitable and those that lack any physical assets. Companies like Redfin, Offerpad and Compass check multiple — and in some cases, all — of those boxes, Campbell said.

“Tech is getting wiped out,” he continued. “Unprofitable growth is getting wiped out.”

A company like Anywhere has some exposure in that regard, but it’s less than that of, say, Compass, which has yet to make money and which has made technology a major focus. Those differing strategies, then, may explain some of the companies’ different fortunes in the stock market.

Why does any of this matter?

For real estate professionals on the ground, stock market performances may seem like a remote and minor concern. An agent at Coldwell Banker, after all, isn’t going to see many day-to-day impacts as parent company Anywhere rises and falls on investors’ balance sheets.

But Campbell said the stock market carnage could ultimately have significant impacts on the industry. Most obviously, companies such as Compass and eXp have made stocks a major part of their pitch. If those stocks are worthless, they’re “not a retention tool,” Campbell said.

Compass recently ditched its stock program for new agents. But existing agents still hold shares, and in some cases, companies have vesting schedules that mean agents have to wait to cash out their equity. And there are still companies such as eXp offering stock. All of which means that if real estate companies perform poorly in the market, agents might decamp to rival brokerages.

That outcome isn’t guaranteed and Compass, in particular, is betting that agents will stick around for the technology and culture. But Campbell speculated that a company like Anywhere — which doesn’t include stock as part of its pitch — could try to take advantage of the current moment and scoop up agents.

Another possible risk from these stock market declines is insolvency. Campbell said that companies with fast-declining share prices may not be able to meet their debt obligations, which can ultimately lead to the existential threat of bankruptcy. Campbell noted that Redfin currently has debt, meaning it theoretically could face this risk at some point, though Compass does not.

Even companies where insolvency isn’t a serious issue could end up getting delisted from the Nasdaq. In order to remain in the market, companies have to keep their share prices above $1. Falling below that threshold means they can be booted from the market, which both makes it harder to trade their shares and can scare away investors.

Right now, most real estate companies still have some wiggle room before they get to the $1 threshold. But the trend lines suggest some are moving in that direction. And a company like Offerpad was less than a dollar away by the end of the week.

Finally, Campbell said that if real estate companies can’t turn things around in the stock market, investors such as Softbank — the Japanese venture fund that fueled the rise of Compass, Opendoor, WeWork and many others — could ultimately sour on the sector. While such an outcome might be welcome news to agents and brokerages competing with venture-backed behemoths, Campbell suggested that a future with less investment would also be less dynamic and innovative.

Either way, though, the future remains uncertain — which Campbell said is not something investors like.

“Wall Street does much better with bad news than with uncertainty,” he said. “You can’t hedge. You just don’t know what to do.”