New markets require new approaches and tactics. More than 250 experts and industry leaders will take the stage at Inman Connect New York in January to help you navigate the market shift — and prepare for success in 2023. Register today and get a special offer $1099 ticket price.

Despite nearly a quarter of homesellers slashing their asking prices amid a market slowdown, homebuyers still canceled purchase contracts at a record rate in October, according to Redfin on Monday.

Pending sales declined a record 32.1 percent in October, the highest rate of decline since Redfin began tracking market activity in 2013. More than 17 percent — or 60,000 — deals fell through, as rising mortgage rates and inflation pushed homebuyers back to the sidelines in hopes of more friendly market conditions in the coming year.

“The Fed’s actions to curb inflation are causing the housing market to slow at a pace not seen since the financial crisis,” Redfin Economics Research Lead Chen Zhao said in a prepared statement.

Allentown, Penn. (-54.9 percent), Greensboro, NC (-50.4 percent), Honolulu (-47.3 percent), Salt Lake City (-46 percent) and Jacksonville (-45.9 percent) took the biggest hit in annual pending home sales, with Jacksonville, Fla. experiencing the highest share of home-purchase cancellations (30.6 percent).

Tampa (26.7 percent), San Antonio (26.6 percent), Atlanta (25.2 percent) and Las Vegas (25.1 percent) also experienced double-digit cancellations, with at least a fourth of buyers pulling the plug on their purchases in October.

Affordable secondary markets seemed to escape the worst of buyers’ fall fallback, with pending sales declining the least in McAllen, TX (-6.6 percent), Rochester, NY (-14.2 percent), Detroit (-14.4 percent), Buffalo, NY (-15.1 percent) and El Paso (-15.8 percent).

Meanwhile, buyers in pricier markets took advantage of widespread price cuts with less than a tenth of buyers in San Francisco (6 percent), followed by San Jose (8 percent), Nassau County, NY (8.2 percent), Montgomery County, PA (9.3 percent) New York (10.5 percent) canceling deals.

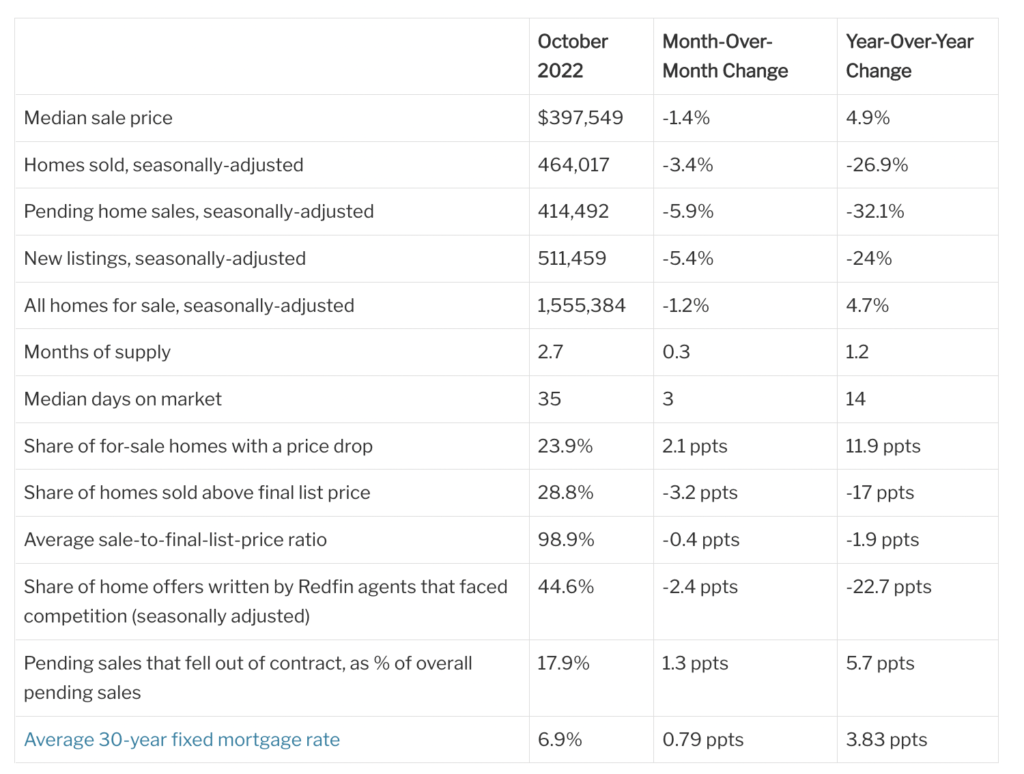

Redfin’s October market overview.

In response to waning demand, the number of new and active listings took a sizeable hit.

New listings fell the most in Cape Coral (-50.8 percent), followed by Boise (-49.8 percent), Greensboro (-46.3 percent), Allentown (-42.1 percent) and Baton Rouge (-39.3 percent), and fell the least in McAllen (-0.4 percent), New Orleans (-3.2 percent), Detroit (-6.3 percent) and Rochester (-7.8 percent).

Only one market —El Paso, TX—experienced a 3.3 percent increase in new listings.

The number of active listings (e.g. the total number of homes for sale) fell the most in Hartford, CT (-32.6 percent), Milwaukee (-29.3 percent), Greensboro (-27.8 percent), Bridgeport, CT (-27.6 percent) and Allentown (-25.8 percent) while active listings experienced the biggest leap in North Port (46.9 percent), Austin (42.3 percent), Nashville (40 percent), Tampa (33.2 percent) and Phoenix (32.9 percent).

As with other market metrics, the average days on market and share of homes sold above asking price varied wildly.

Rochester (10 days), Omaha (11 days), Grand Rapids (11 days) Columbia, SC (12 days) and Buffalo (12 days) had the quickest median days on market, with homes in Chicago (61 days) Honolulu (59), West Palm Beach, FL (58), New York (57) and Lake County (56) staying on market for nearly two months before going under contract.

Unsurprisingly, Rochester had the highest share of homes sold above asking price (65.4 percent), followed by Buffalo (60.1 percent), Hartford (58.5 percent), Worcester (52.1 percent) and Camden, NJ (50.9 percent). Meanwhile, barely a fourth of listings in North Port (12.9 percent), Cape Coral (13.5 percent), Phoenix (13.6 percent), West Palm Beach (13.9 percent) and Boise (14 percent) sold above asking price.

Looking forward, Zhao said improving inflation and mortgage rates could encourage homebuyers to return to the market in early 2023; however, they may not have as much negotiating power.

“There are already early but promising signs that inflation is cooling, which caused mortgage rates to drop last week,” he said. “If that progress continues, buyers who recently backed out of deals may return to the market and sellers may be less inclined to slash their prices.”