In parts of the country, buyers are backing out of contracts for new homes at rates not seen since the shock of the pandemic first set in during March of 2020.

In a shifting real estate market, the guidance and expertise that Inman imparts are never more valuable. Whether at our events, or with our daily news coverage and how-to journalism, we’re here to help you build your business, adopt the right tools — and make money. Join us in person in Las Vegas at Connect, and utilize your Select subscription for all the information you need to make the right decisions. When the waters get choppy, trust Inman to help you navigate.

More buyers are backing out of their contracts for new homes under construction and putting builders in a tough bind amid a decline in demand.

And in some of the once-hottest markets — such as Denver — the pullback from buyers may even be deep enough to rival what happened in the earliest days of the pandemic when clients withdrew from the market in droves during March of 2020, before diving back in soon afterward.

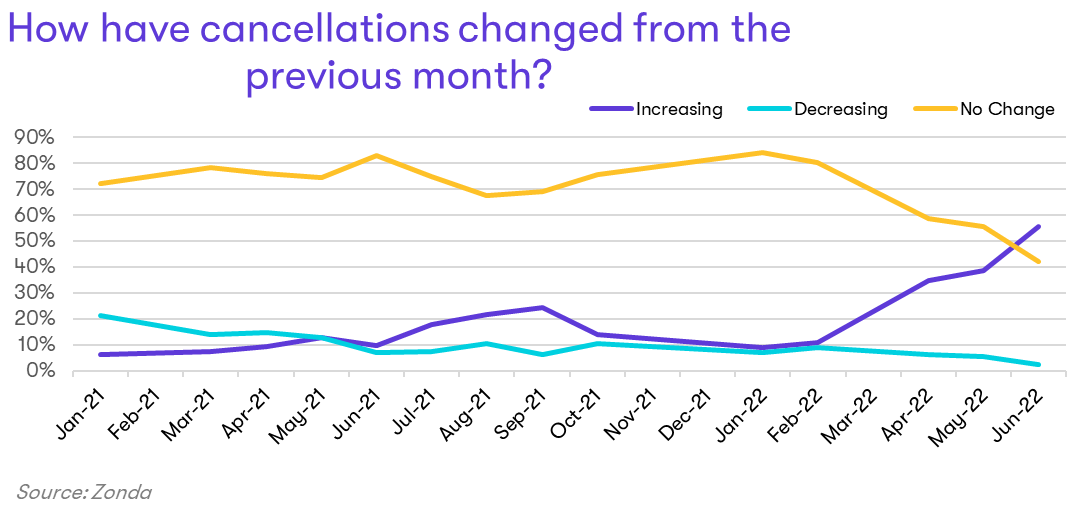

More than half of builders nationwide in Zonda’s monthly survey reported an increase in cancellations during June, according to the market research firm’s Chief Economist Ali Wolf. And the share of builders affected by rising cancellations has been on the upswing in each of the past five months.

Responses from Zonda’s monthly division president survey of homebuilders

“Builders reporting an increase in cancellations does not necessarily mean the cancellation rate is high across the board — cancellations were virtually nonexistent during the housing boom since 2020 so a rise is coming from a low base,” Wolf wrote to Inman. “A rise in cancellations does, however, indicate that housing demand has slowed quickly, either by choice or by force.”

Several factors are at play here, she said.

For one — the steep declines in resale inventory that occurred earlier in the pandemic have begun to reverse, meaning more options for existing homes are competing with new builds for buyer attention.

For another — general nervousness about the market may be driving more buyers to pull out of deals and observe from the sidelines.

And third — higher prices and mortgage rates are driving a segment of buyers out of the market for new homes altogether.

During normal times, buyers rarely back out of a contract for a home under construction with perhaps 1-in-5 canceling on a typical year.

In the first two years of the pandemic cancellations became even rarer as shown in this chart from John Burns Real Estate Consulting’s director of research.

Homebuilder cancellation rates back to 2005. Heading higher for sure in coming quarters. Seeing it real-time in our survey work and industry conversations. pic.twitter.com/zTOFUHGYP9

— Rick Palacios Jr. (@RickPalaciosJr) June 30, 2022

But it wasn’t that long ago that cancellations spiked to as high as double their normal rates. During the housing crash and the early years of the Great Recession, cancellation rates hovered around 35 percent for an extended period of time, according to John Burns’ numbers.

Numbers were nearing these heights once again in Denver, according to a chart Wolf shared on Twitter.

Cancellation rate not leveling off for Denver yet (through Sunday) https://t.co/ducqrmgilM pic.twitter.com/Qk579vSCow

— Ali Wolf (@AliWolfEcon) July 6, 2022

In an email to Inman Wolf cautioned against drawing too strong a conclusion from these Denver numbers, which are based on a relatively small sample size from a single market during the seven-day period ending July 3.

But she added that Denver does appear to be one of the markets where cancellations are especially high right now alongside Sacramento, Austin, Houston and Phoenix. Each of these metros was among the hottest real estate markets over the previous years, Wolf wrote.

When a buyer backs out, the homebuilder retains several options for selling the house under construction. And for now, at least builders appear to be optimistic they can continue to move inventory — just on less favorable terms, Wolf told Inman.

“Many builders report that they can still resell these homes, but as demand fades, some builders are needing to offer incentives or drop prices to secure the sale,” Wolf wrote.