On-chain data shows 63.2% of all PEPE holders are now holding some profit. Here’s how this compares against DOGE, SHIB, and other memecoins.

PEPE Has Recently Woken Up With Fresh Rally And On-Chain Activity

According to data from the market intelligence platform IntoTheBlock, PEPE’s latest price surge of over 37% during the past week has meant that its holder profitability ratio has observed a significant jump.

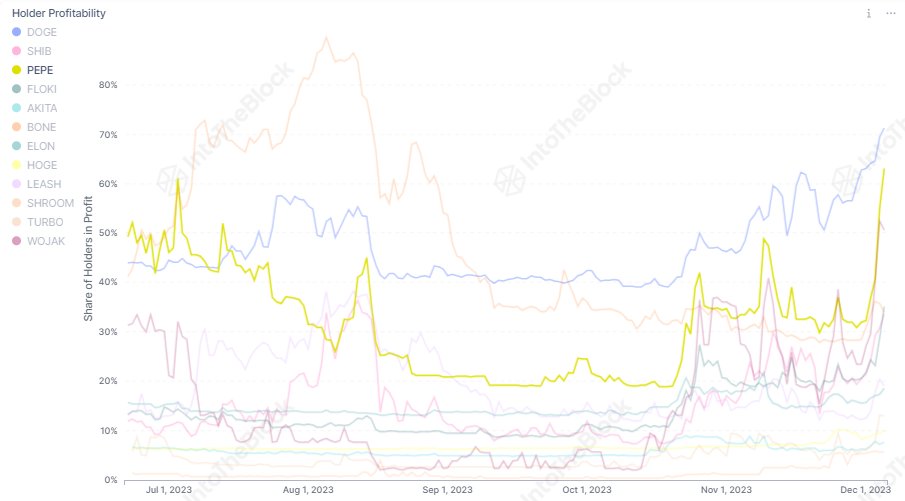

The below chart shows how the percentage of the holders carrying some unrealized profit has changed for PEPE during the last few months and also how the same metric compares for the other meme coins in the sector like DOGE and SHIB.

The value of the metric appears to have shot up for PEPE in recent days | Source: IntoTheBlock on X

Following this surge, around 63.2% of PEPE’s user base is holding their coins with positive returns. As is visible from the chart, the frog-based memecoin’s profitability ratio is now the second highest among these assets, above the likes of Shiba Inu and Floki.

Dogecoin still remains the top meme coin based on this metric, however, as more than 70% of its investors are in the green. The indicator’s recent surge has been slower for DOGE, though, so if PEPE can keep up its rise, it might overtake the original meme-based token.

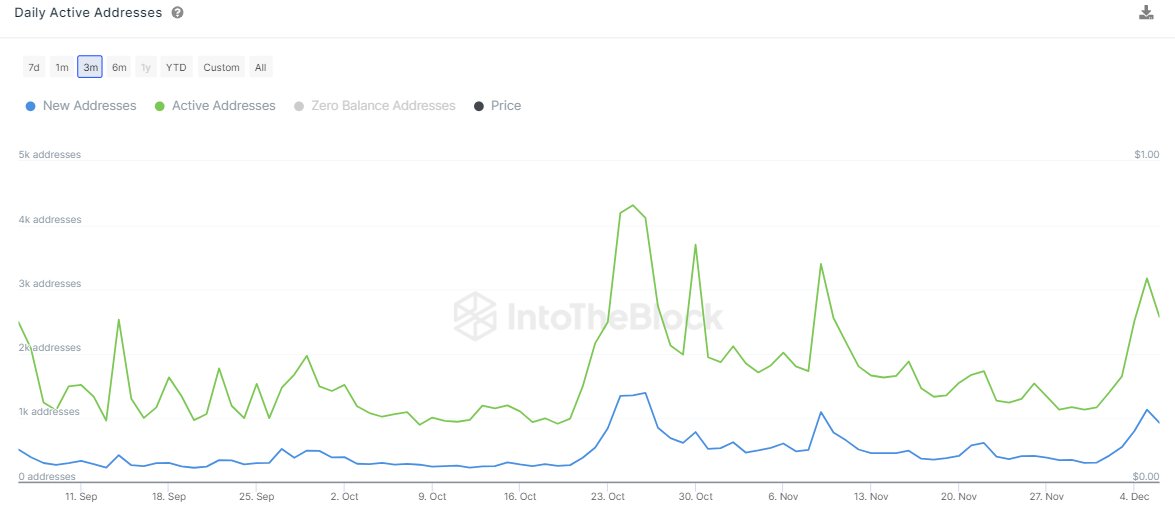

The profitability ratio isn’t the only indicator that has improved for the cryptocurrency recently, as IntoTheBlock notes, its active addresses have also registered a rapid increase.

Looks like the indicator's value has seen a sharp surge | Source: IntoTheBlock on X

The “active addresses” refer to those addresses that are taking part in some sort of transaction activity on the blockchain, whether as a receiver or sender. From the above graph, it’s apparent that the total number of active addresses has shot up for PEPE recently, a sign that investors have become quite active.

A high amount of users participating on the network is usually a positive sign for a rally’s sustainability, as it means that it might be able to keep itself fueled for longer. It’s usually a worrying sign when rallies take place, but activity drops instead.

It’s not the case for this surge of the meme coin, of course, as user interest in the cryptocurrency has appeared to be high. It’s not just the regular investors that are showing interest in the asset, either, as the large transactions on the network have also observed significant growth recently.

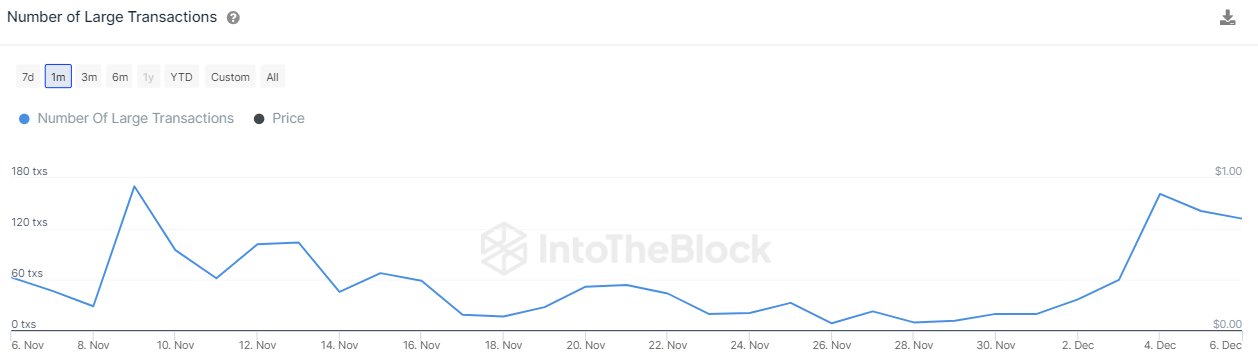

The number of large transactions on the blockchain have also seen an uplift | Source: IntoTheBlock

The large transactions refer to those transfers that are carrying at least $100,000 in value. Not too long ago, there were just 10 such large daily transactions happening for the memecoin, but now the count has grown to more than 160.

Typically, such transactions are a sign of movement from the whales, so the indicator going up for PEPE suggests that these humongous entities also have an active interest in trading the coin currently.

Memecoin Price

After its recent rally, PEPE is now trading around the $0.00000151529 mark.

The value of the asset has been moving sideways since the initial surge | Source: PEPEUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com