The price of Bitcoin presses on towards the upside and, once again, touched a critical resistance close to $38,000. The cryptocurrency could trend sideways at its current levels in the short term, leading analysts to find the support level that could withstand a spike in selling pressure.

As of this writing, Bitcoin trades at $37,160 with sideways movement in the last 24 hours. BTC held a 2% profit the previous week, while Cardano (ADA) and Solana (SOL) took the lead in the current price action.

The History Of Bitcoin Reveals Mega Bottom For The Current Cycle?

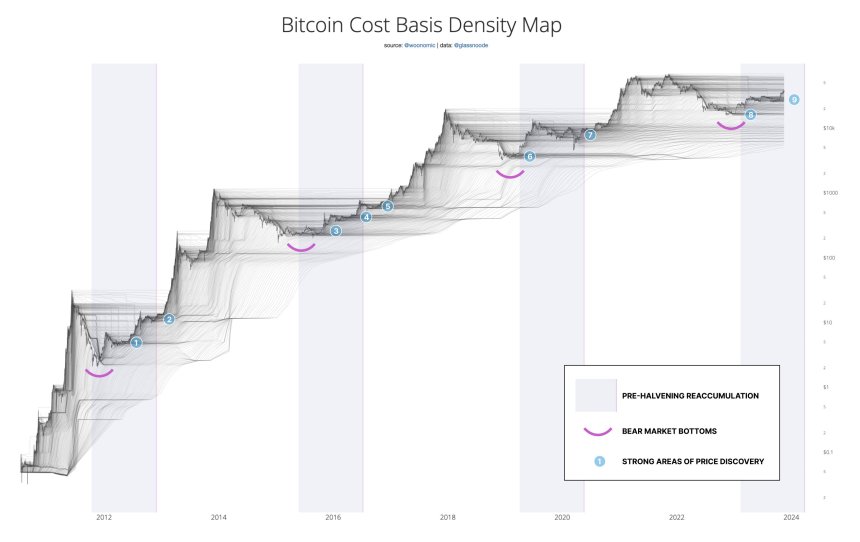

On-chain analyst Willy Woo shared a prediction on his social media channels based on the Bitcoin Cost Basis Density. The analyst investigated the BTC supply dynamics to find where the cryptocurrency could hold off the bears.

Based on his findings, the analyst stated that Bitcoin is unlikely to revisit the $30,000. As seen in the chart below, each time in BTC’s history that the supply moved to long-term investors, the cryptocurrency trends to the upside without returning to this price point: $30,000 for the current cycle.

The analyst set 3 conditions to confirm this pattern: first, Bitcoin must be exiting a bear market; second, there must be signs of a “high agreed price;” finally, the cryptocurrency must be about to go through a “Halving Event.”

During the latter, the supply rewards for mining BTC are cut in half along with its production, which often leads to “supply shocks,” according to some analysts. Halving events coincide with the BTC bull run, but other analysts warned against corresponding Bitcoin bull runs with the reduction in its supply.

The Biggest Narrative Driving The Bull Run

However, Woo claims that the potential approval of a Bitcoin Exchange Traded Fund (ETF) might be the more significant catalyst for the cryptocurrency. If the US Securities and Exchange Commission (SEC) approves the product, billions of dollars flow into the cryptocurrency.

The analyst added:

Bitcoin is far from a commodity market at saturation. What we’re seeing across the 13 yrs of this chart is BTC’s widespread adoption. The network had 10,000 users in 2010, today there’s well over 300m people using it as a store of value technology. This is only going to climb with a spot ETF.

The majority of users replying to Woo’s forecast highlighted his 2021 prediction. At that time, the analyst also set some levels that were supposed to hold against a selloff but quickly folded against unprecedented selling pressure.

It remains to be seen if this prediction will suffer the same fate or if the Bitcoin price can hold above $30,000 for the next bull cycle.

Cover image from Unsplash, chart from Tradingview