More than half of the homes built since the start of 2020 are at an elevated risk of wildfire. Redfin’s research team takes a look.

With the industry and the market changing faster than ever, make plans to come together with the best community in real estate at our flagship event. Join us at Inman Connect New York, Jan. 24-26, and punch your ticket to the future. Check out these just announced speakers for this must-attend event. Register here.

More than half of homes built in recent years are at an elevated risk of wildfire damage, and the chance of other disasters looms larger than before, a new report suggests.

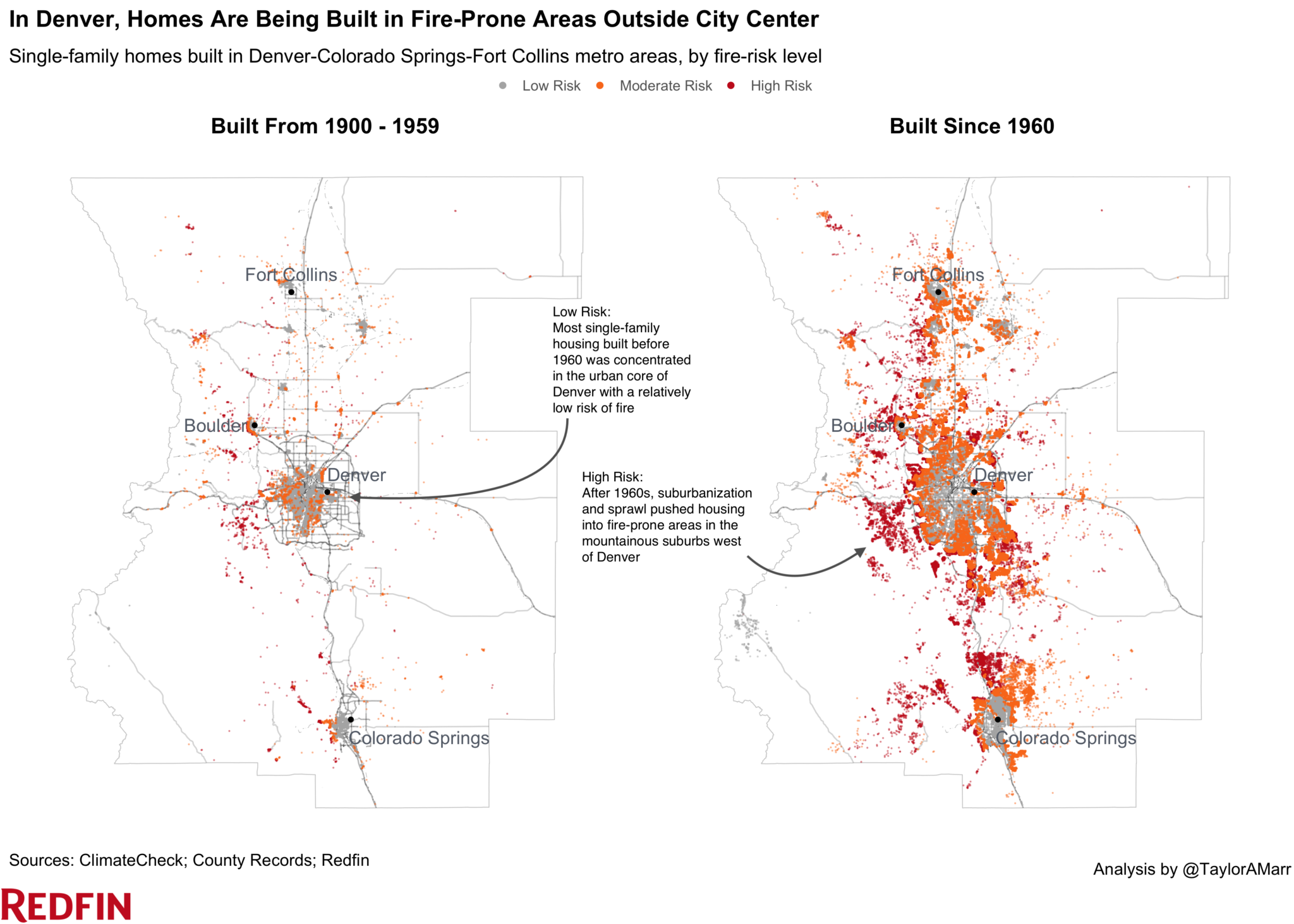

This change may be driven in part by the development of suburban neighborhoods and a general population shift toward warmer climates, according to a Redfin analysis of ClimateCheck data.

For wildfire risk, the shift is notably stark. Of the homes built between 1900 and 1959, about 14 percent were at risk of wildfire. Since the start of 2020, the share of residential properties erected that are at risk of wildfire has been nearly four times greater than that — amounting to 55 percent of recently built homes, the data found.

“The areas that are already built are at lower risk of wildfire because they’re not surrounded by forest and trees—they’re surrounded by other buildings,” economist and author Jenny Schuetz told Redfin’s research team.

These numbers on their own may overstate the risk to America’s total housing stock, the report cautions. The vast majority of U.S. homes were built before 1990, the U.S. Census Bureau estimates. Only about 4 percent of homes were built since the start of 2014.

But as homebuilders continue to chip away at the housing supply shortage, they appear to build primarily in areas that will be at higher risk of natural disasters in the future and possibly more expensive to insure against damage from these events.

Homeowners appear to downplay this risk when choosing a spot to relocate or build a house. Schuetz told Redfin’s research team that debt-financed home purchases and insurance against disaster events help insulate buyers against the potential consequences of where they’re moving.

“It’s obviously traumatic if your house burns down in a wildfire or gets hit by a hurricane, but financially, homeowners often get bailed out,” Schuetz told the team.

While increases in wildfire risk are posing the most quickly increasing threat to the nation’s new housing stock, other threats are on the rise as well.

Since the start of 2020, 45 percent of newly built homes face at least a moderate risk of drought, by ClimateCheck’s definition. The share of homes with elevated drought risk was up from 37 percent of those that were built between 1900 and 1959, the study found.

A greater share of recently built homes is also at higher risk of flooding and heat than the ones built in the early part of the last century. Each of these shares of at-risk homes grew by about 4 percentage points in the same span of time.

But storm risk has actually declined as more new communities have shifted away from the Northeast.

In the first six decades of the 20th century, 89 percent of newly built homes faced an elevated risk of storm damage. Now, 78 percent of newly built homes face that same risk level.

Overall, the threat from natural disasters to the nation’s housing stock appears to be on the rise as buyers continue to build into less developed areas.

“In the West, the wildfire-prone areas are in the undeveloped lands, and so the farther we push toward the undeveloped lands, the more houses are going to be at risk,” Schuetz told Redfin.

Editor’s Note: Cal Inman is the son of Brad Inman, founder of Inman Group. Brad Inman is part of the ClimateCheck team; however, Inman Group is not affiliated with ClimateCheck in any way.