The bulls seem to be back in control following the return of the Bitcoin price to above $43,000 this past week. This positive run comes on the back of a period where the premier cryptocurrency struggled, falling below $41,000 at some point.

However, the market leader appears to have regained most of its lost momentum, with new heights now in sight. A popular crypto pundit on the X platform has put forward a new prognosis and set a new target for the Bitcoin price.

BTC Price To $47,000? Here’s What Needs To Happen

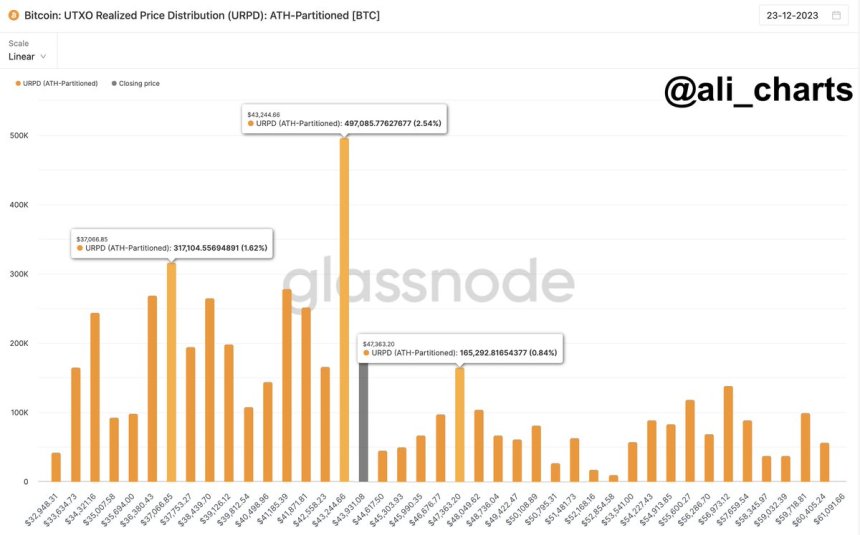

In a post on X, crypto analyst Ali Martinez offered insight into the price action of Bitcoin, explaining the potential movements of the cryptocurrency over the coming weeks. This evaluation is based on the UTXO Realized Price Distribution (URPD) data by the on-chain analytics firm Glassnode.

A chart showing the UTXO Realized Price Distribution of Bitcoin | Source: Ali_charts/X

Martinez identified the $43,200 area as a crucial support level, which can potentially determine the fate of Bitcoin’s price. The premier cryptocurrency broke above this price zone on Wednesday, December 20, and has been trading mostly sideways since.

In his post, Martinez highlighted that so long as the vital $43,200 support holds, the momentum is with the Bitcoin bulls. According to the crypto analyst, staying above this support is one catalyst that could push the Bitcoin price to above $47,360.

On the flip side of his analysis, he noted that the Bitcoin price could possibly undergo a correction. The crypto pundit emphasized that one of the bearish signals to watch out for is a sustained close below the crucial $43,200 mark.

According to Martinez’s projection, a close below $43,200 could send the price of BTC down towards $37,000. This would mean a decline of over 15% from the current price point.

Bitcoin Price Overview

As of this writing, the Bitcoin price stands at $43,783, reflecting a mere 0.5% gain in the last 24 hours. On the weekly timeframe, though, the premier cryptocurrency has shown tremendous recovery to return back to its heights of early January.

According to data from CoinGecko, the value of BTC is up by more than 4.5% in the past seven days. Meanwhile, the coin’s price has surged by nearly 16% in December as the market leader looks to close out the year on a high.

Bitcoin continues to maintain its position as the largest cryptocurrency in the sector, with a market cap of roughly $858 billion.

BTC price experiences correction at $44,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.