Current CoStar report finds “a continued downward trend in rent growth,” as vacancy rates tick upward and rent price growth cools. The Sun Belt and South continue to see the fastest growth.

In a shifting real estate market, the guidance and expertise that Inman imparts are never more valuable. Whether at our events, or with our daily news coverage and how-to journalism, we’re here to help you build your business, adopt the right tools — and make money. Join us in person in Las Vegas at Connect, and utilize your Select subscription for all the information you need to make the right decisions. When the waters get choppy, trust Inman to help you navigate.

In the latest sign of a rental market cooldown after a period of historic rent growth, CoStar reported last week that the rate of multifamily rent growth began to slow during the second quarter of the year.

Rent was still 9.2 percent higher in the second quarter than a year before, according to the online rental marketplace CoStar. That’s down from the first quarter when rents rose 11.4 percent over the same period in 2021 and the third straight quarter with a drop in rental prices.

The report seems to solidify that the rapid run-up in rents which started a year into the pandemic may be slowing back down. As the for-sale market cooled with rapidly-rising interest rates, rent growth appears to be on the same trajectory.

“Rent growth moderation in the second quarter is directly tied to the lackluster demand that we have seen over the past 90 days,” Jay Lybik, national director of multifamily analytics for CoStar, said in a statement.

Lybik said an ongoing boom in residential construction could lead to more rental supply and more downward pressure on rent. The report found the national vacancy rate rose to 5 percent in the quarter.

“Combine the fact that rent prices continue to sit at all-time highs with tempered consumer demand and a record 450,000 units expected to be delivered by year’s end, and you have a perfect recipe for a sharp rise in vacancy rates in the next 6 months,” he said.

CoStar

Last month online rental marketplace Zumper reported rent rose 0.5 percent over May, which was significantly cooler than the growth rate of 1- to 2 percent in previous months.

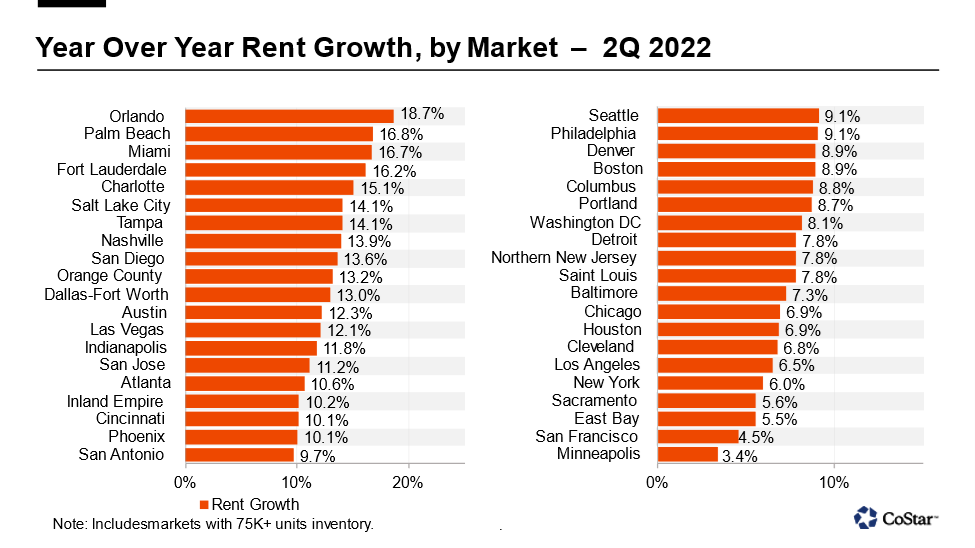

Rent growth in the Sun Belt and Southeast remained above the national average even as it slowed, according to the CoStar report.

Those areas have been a target of investors in recent years, with both large institutional and independent investors scooping up homes and multifamily buildings. As many as one in three homes sold to investors in recent years.

“While national multifamily rental growth is mostly slowing across the country regardless of city, the Sun Belt and South continued to exceed the national average,” according to the report.

Four cities in Florida held the top spots for largest rent growth during the quarter.

Orlando, Florida, led the way with second-quarter price growth at 18.7 percent, more than double the national average. Orlando was followed by two other Florida cities — Palm Beach and Miami — with the second- and third-highest rent growth during the quarter.

Multifamily rent in Palm Beach rose 16.8 percent in the quarter. It rose 16.7 percent in Miami and 16.2 percent in Fort Lauderdale.

The report included a warning that the broader economic trends including inflation and economic uncertainty in general, are having negative impacts on the multifamily market.

“These factors have pushed consumer confidence to record lows despite employment growth averaging almost 500,000 jobs a month year to date and unemployment sitting at just 3.6 percent,” the report said.

Get Inman’s Property Portfolio Newsletter delivered right to your inbox. A weekly roundup of news that real estate investors need to stay on top, delivered every Tuesday. Click here to subscribe.